Starting to invest early can be challenging.

As you enter the workforce after college, numerous immediate priorities are vying for your attention:

➡ Settling into post-graduation life

➡Considering marriage

➡Repaying student loans

Once you’re married, a new set of priorities comes up:

➡Deciding whether to buy or rent a home

➡Planning for your children’s education costs

➡Evaluating your career path

With so many pressing concerns, it’s easy to see why investing for the future might not be a top priority.

Saving for a version of yourself 40 years from now can feel counterproductive when you’re worried about more immediate financial obligations, like paying health insurance deductibles.

I understand these challenges but stay with me.

Consider this scenario:

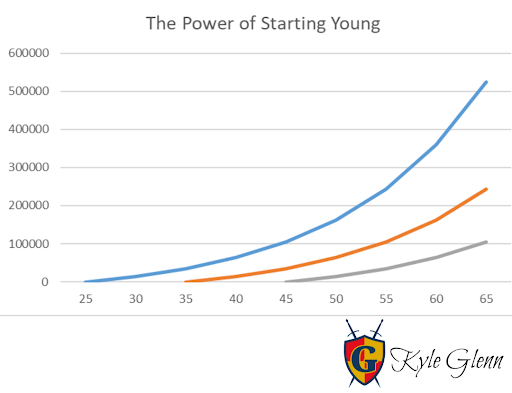

Let’s look at three different people

- Ages 25, 35, and 45

- Each invests $200 a month

- Each earns a perfect 7% annual return

Those who start investing at 25 will have nearly $300k more than those who start at 35!

To achieve the same result:

The 35-year-old will need to save $430 per month ($230 more!)

The 45-year-old will need to save $1,008 per month ($808 more!)

Starting early requires less effort than starting later.

This is just one way working with a financial planner can help you get to where you want to go!

Remember, these numbers are for educational purposes only and don’t guarantee any results. But they illustrate a crucial point: starting to invest early can significantly impact your financial future.